|

|

|

|

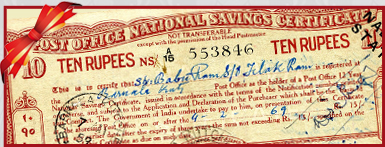

| 1. National Savings Certificate |

|

|

|

|

National Savings Certificate (NSC) is a popular tax-saving instrument under section 80 C of the Income Tax Act. Any adult can buy NSC in his or her name or on behalf of a minor.

The certificate, which has a maturity of six years, is available for purchase at all Post Offices in India. The minimum amount of investment under NSC is . 100. Certificates are available in denominations (face value) of . 100, . 500, . 1,000, . 5,000 and . 10,000.

NSC offers an interest rate of 8%, compounded half-yearly. If you invest . 1,000, the amount grows to . 1,601 in six years. The interest earned on NSC is taxable. But it follows a cumulative interest principle. Hence, the interest is |

|

| |

is not paid to the investor every year. It gets accumulated over a period of six years.

The interest component of the first five years is reinvested and qualifies for fresh deduction under Section 80 C. Only the final year’s interest at maturity does not get a tax benefit as it is paid back to the investor.

If you are looking to save tax under section 80C, it is better to opt for a judicious mix of NSC and Public Provident Fund (PPF) to benefit from interest rate movements in either direction. The interest rate is revised at regular intervals in PPF, but the rate is locked in NSC for six years. For example, if the interest rates have been falling, you may end up getting a better rate on NSC.

However, your investments in PPF would gain more if the interest rate scenario turned around.

As a rule, people with higher salary should avoid NSC. This is because the net return from NSC becomes less attractive for individuals after paying the taxes. If an individual falls in the 30% tax bracket, he earns only 5.6% post-tax return in NSC. |

| |

|

|

|

|

| Top | Back |

“What is with these guys? They need a never ending supply of money. What do they think, money grows on trees? Last week it was for some educational trip from the college and this time it is some friend’s birthday party in some hotel, for which he has to buy new clothes.

With a teenager at home, one can never budget expenses or plan finances, trust me”, this was Aditya cribbing to his colleagues at work. That evening when Aditya was driving back home, his friend Prashant who lives close to Aditya’s house requested a drop. Aditya was more than happy to oblige and they got talking.

Both Aditya and Prashant had teenaged sons and they always shared notes on |

|

|

| 2. Make your teenager a deputy finance manager!! |

|

|

|

|

investing, parenting etc. Prashant recalled the morning discussion and said softly, “Hey Aditya, I tried a few things and it worked. Now my son is the deputy finance minister at home. Very helpful too. You know that?”

Prashant went about explaining

- Prashant gives his son Dhanush pocket money or allowance. Every 1st and 15th of the month Prashant gives him a specific amount. Dhanush has to manage all his expenses within it. They did have some tough time deciding how much this amount should be. However, Prashant agreed to give a bit more than what Dhanush would absolutely need. Dhanush should save up any extra money that he has not spent and use them for the birthday parties and extra clothes. No money is given on demand in between. Of course, Dhanush does borrow money once in a while, but returns it promptly; otherwise it is deducted at source from the allowance.

- This has helped Dhanush understand that only a certain amount of money is available and that he should manage his expenses within them. He has become so very creative and a very careful consumer.

- Last week, when they went on a family holiday Dhanush had so much knowledge of where to go for best deals and even used his negotiation skills to get a great holiday package. He knows where you can get great food, clothes, shoes, mobile phones, accessories at dirt-cheap prices.

- Prashant has now given the responsibility of maintaining the family budget on the computer to Dhanush. Dhanush has an iphone and tries everything new in technology. So both mom and dad shoot out a sms to Dhanush when they spend on something. Dhanush puts them up on an excel sheet, or some downloaded budgeting software. In addition, the tough part of this is that at the end of every month Prashant and wife have to sit for a Power Point presentation by Dhanush on how they have spent and how they can improve!

- Another place Dhanush enjoys going to is the bank. He says he goes there to enjoy the ambience as well as the ever-smiling receptionist, but frankly it is so very helpful when you have to just drop a cheque or pay some bills. The bank is after all on the way to his college and there are ATMs and drop boxes in every mall where he hangs out all the time. He takes all his fee DDs himself and gets his work done around in the bank.

- Stock markets are now his latest fetish. Though Prashant is a bit wary of the markets himself, Dhanush has taken a lot of interest and tracks the market on his mobile phone. Intelligently Prashant has put his son onto one of his investment banker cousins who Dhanush admires a lot and they do a lot of stock market research together. Prashant is not sure how this will help his family finances but is happy Dhanush is getting to learn a lot of things about the commodity he would use most in life – Money.

- When Dhanush came one day saying he wanted to take up a part time job with a neighbourhood juice shop, all hell broke loose. Prashant’s wife was wild. She started blaming and accusing Prashant of pushing her son to work as a waiter. She even offered to scrap the allowance plan and give money whenever Dhanush wanted. However, Prashant saw the benefit – Dhanush would learn dignity of labour, understand that money does not come easy and this would look great on Dhanush’s resume too. Prashant convinced his wife and let his son take up that job as long as it did not come in the way of his studies and on the promise that Dhanush would not use the money for undesirable things. It worked. Dhanush now takes pride in earning money, feels useful and now even empathises with dad for how hard he works.

Moral of the Story: The youngsters at home want to feel important. When a responsibility is given, they do not cease to surprise us on how well they can handle it. Teenagers should learn about money and they will best do it when the opportunities are presented to them. Give it to them.

With inputs from Bankbazaar |

|

| |

|

|

|

|

| Top | Back |

|

| 3. Know the difference between tax planning & tax avoidance |

|

|

|

|

The interface between tax planning and tax avoidance has been a constant subject matter of debate between taxpayers, tax authorities and judicial authorities. In the recent years, we have been witnessing a significant change in the approach of tax and judicial authorities across the globe, who are closely scrutinising transactions entailing reduction of taxes.

Tax incidence can be reduced through tax planning, tax avoidance or tax evasion. To begin with, there is a thin line separating 'tax planning' from 'tax avoidance'. Legitimate tax planning may reduce the incidence of tax but impermissible tax avoidance may lead to tax and penal consequences.

|

|

| |

Tax planning may be defined as an arrangement of one's financial affairs to take full advantage of all eligible tax exemptions, deductions, concessions, rebates, allowances permitted under the Income-Tax Act, 1961, so that the tax burden is minimised in the hands of the taxpayer without violating the legal provisions.

For instance, tax planning can be done by investing in specified permissible avenues eligible for deduction under section 80C or investment in an SEZ unit. It is legitimate as the legislature intends optimum utilisation of these deductions and exemptions to promote economic activity in the country.

Tax avoidance is reducing or negating tax liability in legally permissible ways by structuring one's affairs. Any such transaction would be valid only if it has commercial substance and is not a colourable device. The Supreme Court, in M/s McDowell and Co Ltd Vs Commercial Tax officer, 1985, (154 ITR 148(SC), held that for tax planning to be legitimate it must be within the legal framework and colourable devices cannot be part of tax planning. In deciding whether a transaction is a genuine or colourable device, it is open for the tax authorities to go behind the transaction and examine the "substance" and not merely the "form".

The recent Vodafone controversy is an attempt by the tax authorities in this direction. In the case of Vodafone, the shares of a foreign company were transferred by one non-resident to another non-resident where the only principal asset of the foreign company was shareholding in the underlying Indian company. The tax authorities, disregarding the corporate veil, treated the transfer of shares of the foreign company as effectively resulting in transfer of shares of the Indian company and taxed the capital gains arising on such transfer of shares in India. The contention of the tax authorities was upheld by the Mumbai High Court and the matter is now pending before the Supreme Court.

Tax evasion is the method or means by which the tax is illegally avoided through unacceptable means. It refers to a situation where a person tries to reduce his tax liability by deliberately suppressing the income or by inflating the expenditure, recording fictitious transactions, etc.

It is to be noted that the proposed Direct Tax Code (DTC) provides for general anti-avoidance rules (GAAR) to address the concerns of tax avoidance. The provisions of GAAR may be invoked by the commissioner of income-tax, wherein a taxpayer has entered into an arrangement to obtain tax benefit and such arrangement fulfils any one of the following conditions:

» It is not at arms length; or

» It represents misuse or abuse of the provisions of DTC; or

» It lacks commercial substance; or

» It is entered into or carried on in a manner not normally employed for bonafide business purpose.

To avoid arbitrary application of GAAR, it is expected that the Central Board of Direct taxes will provide the threshold limit and the guidelines to specify the circumstances under which GAAR may be invoked.

Accordingly, the new rules under DTC (ie, GAAR) shall have far-reaching implications on the transactions that lack commercial substance or represent abuse of tax provisions. As such, it is important for the taxpayers to understand the distinction between tax planning and tax avoidance to avoid unwarranted tax and penal consequences.

With inputs from FOUNDER RSM Astute Consulting Group |

| |

|

|

|

|

| Top | Back |

Home loans are easy to come by these days. So, don’t fret over it. Focus on the documents you need to furnish while applying for a home loan.

Documents required:

We give you a standard list of documents your bank will ask for. Besides this you need to submit details of the property or home you are obtaining the loan for.

Tip: Check with your Bank or Non-Banking Financial Companies to figure out which of the following documents you need to submit, as the requirements differ from bank to bank. |

|

|

| 4. Home loans documentation checklist |

|

|

|

|

1. Identity proof

– Driving license

– Voters ID

– Passport

– PAN card

– Ration card

– Employee ID

– Bank passbook

– Letter from a recognized public authority or public servant verifying your photograph

– Confirmation letter from your employer or another bank verifying your photograph

2. Address proof

– Driving license

– Voters ID

– Passport

– Ration card

– Bank passbook or Bank account statement

– LIC policy/ receipt

– Utility bill – telephone, electricity, water, gas (less than 2 months old)

– Letter from any recognized public authority verifying residence address of the customer

– Letter from your employer

3. Age proof

– Driving license

– Passport

– Bank passbook

– PAN card

– Birth certificate

– 10th standard mark sheet

4.Income proof

Income proof and property proof vary for a salaried individual and a self-employed individual.

a. Self Employed/Businessmen

– A brief introduction of Business/Profession

– Balance Sheet, profit and loss account statement of income, proof of income tax returns for the last 3 years certified by a CA

– Photographs

– Receipts of advance tax payments if any made

– A photocopy of Registration Certificate of establishment under Shops and Establishments Act/Factories Act

– Registration Certificate for deduction of Profession Tax

– Certificate of Practice

– Receipts of Bank loans

– Proof of investments (FD Certificates, Shares, any other fixed asset)

b. Salaried individuals

– Income Proof (any one of the following):

Latest Pay slip

Form 16

Increment/Promotion letters

Appointment letter

Pay slip (Last 2 months) with salary account bank statement

Certified letter from Employer

IT returns ( for three years )

– Investment proof (FD certificates, shares, any fixed asset etc.)

– Documents supporting the financial background of the borrower (liabilities and assets if any)

– Photographs

5. Property documents

If a flat is purchased from a builder, you need the following property documents:

– Original copy of your agreement with the builder

– 7/12 extract – This is issued by the concerned land authorities giving details such as the survey numbers, area, date from which current owner is registered as owner etc.

– Property register card, which is obtained from the City Survey Department

– N.A. permission for the land from the collector, if its agricultural – If the land is agricultural and is being utilized for residential/ commercial/industrial use, then such agricultural land has to be converted to non-agricultural land and a Non-Agriculture Order has to be obtained from the Collector of the district where the property is located.

– Search Report and Title Certificate – A search report and title certificate can be obtained from an advocate who will conduct a survey of the title of the property by visiting the office of registrar. A legal opinion can avoid any legal hassles later and is mandatory to be filed with the agreement for sale.

– Development agreement between the owner of land and the builder

– Copy of order under the Urban land Ceiling Act

– Copy of building plans sanctioned by the competent authority

– Commencement certificate granted by the Corporation

– Building completion certificate

– Latest receipts for taxes paid towards the land or property or flat to be purchased

– Partnership deed or memorandum of association of the builders firm

If a flat is purchased from a Cooperative Society, you need the following property documents

– Original share certificate of the Society

– Allotment letter from the Society in your name

– Copy of the lease deed, if executed

– Certificate of the registration of the society

– Copy of the bye laws of the Society

– No objection certificate from the Society

– 7/12 extract or property register card in the Society’s name

– Copy of N.A permission for the land from the collector

– Search Report and Title Certificate

– Copy of order under the Urban Land Ceiling Act

– Copy of the building plans sanctioned by a competent authority

– Commencement certificate granted by Corporation

– The latest receipts of taxes paid for the property

– Original Agreement to assign / Deed of assignment

If you are constructing on your own land, then you will need the following property documents.

– Original sale deed of land and extract of Index II

– 7/12 extract or property register card in your name

– Copy of N.A. permission for land from the collector

– Search and title report

– Copy of tax paid under Urban Land Ceiling Act (obtained from Commissionerate of Urban Land Ceiling and Urban Land Tax)

– Copy of the building plans sanctioned by a competent authority

– Building permission granted by the Corporation

– The latest receipts of taxes paid for your land

– Estimate of the cost of construction certified by the architect |

|

|

| Top | Back |

|

|

Please do not reply back to this mail. This is sent from an unattended mail box.

Please mark all your queries / responses to webmaster@jathananand.com |

Information provided on this newsletter has been independently obtained from sources believed to be reliable. However, such information may include inaccuracies, errors or omissions. www.jathananand.com and its affiliates, information providers or content providers, shall have no liability to you or third parties for the accuracy, completeness, timeliness or correct sequencing of information available on this newsletter, or for any decision made or action taken by you in reliance upon such information, or for the delay or interruption of such information. www.jathananand.com, its affiliates, information providers and content providers shall have no liability for investment decisions or other actions taken or made by you based on the information provided on this newsletter.

|

|

|